On Monday, Lyft announced its acquisition of bike-sharing company Motivate, which is responsible for operating a number of popular shared-bike systems like New York City’s Citi Bike and San Francisco’s GoBike.

In fact, Lyft says Motivate is responsible for 80% of the trips on shared bikes in the US, which would give it a significant competitive advantage over Uber and its newly acquired bike-sharing company Jump. But Lyft’s share is still a small piece of a very large pie.

Cities have increasingly been using bikes and bike-sharing programs to fight pollution. Meanwhile, the ever-growing industry of ride-sharing companies see bike-sharing as “a natural extension” of their approach, as Lyft co-founder and president John Zimmer said in a statement about his own company’s acquisition.

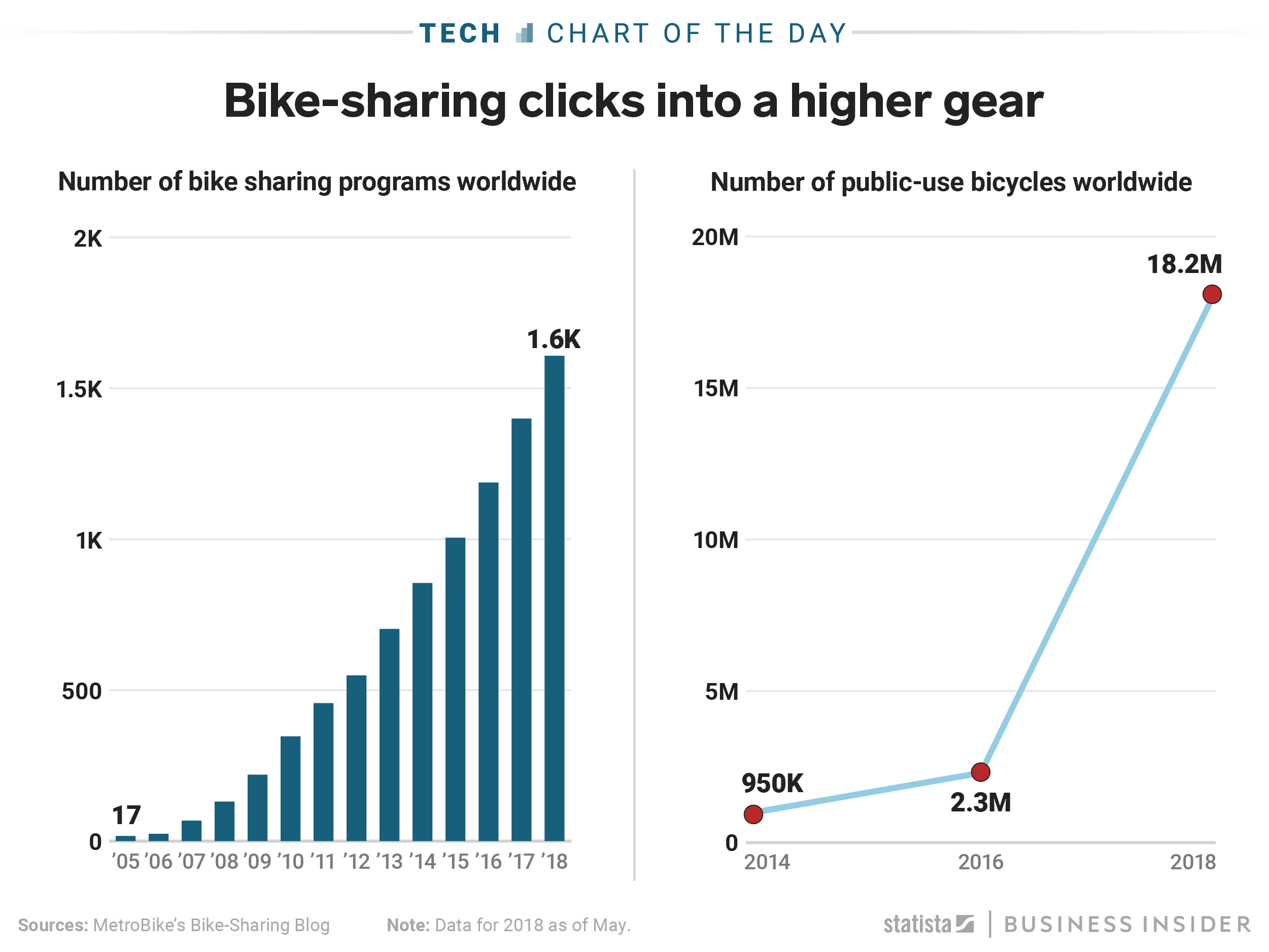

Judging by this chart from Statista, Lyft isn’t alone in its thinking and the other players are more than doubling down on their fleets. According to estimates and data compiled by the Bike-sharing Blog, there are twice as many bike-sharing programs in the world as there were in 2014, and almost 20 times as many bikes available for public use. Lyft and Uber will likely need to increase the number of bikes they have on the road in order to maintain any market share as more ride-sharing companies break into this market.